Can You Connect a Credit Card to Cash App? A Comprehensive Guide

Cash App, the popular mobile payment service developed by Block, Inc. (formerly Square, Inc.), has revolutionized the way people send and receive money. Its ease of use and versatility have made it a staple for everything from splitting bills with friends to receiving payments for freelance work. One common question users often have is: Can you connect a credit card to Cash App? The answer is yes, but there are important details and considerations to keep in mind. This article provides a comprehensive guide to connecting your credit card to Cash App, covering the benefits, limitations, fees, and potential risks.

Understanding Cash App Payment Methods

Before delving into the specifics of connecting a credit card, it’s crucial to understand the various payment methods Cash App supports. Cash App primarily uses two types of funding sources:

- Debit Cards: These are directly linked to your bank account and allow you to use funds readily available in your account.

- Credit Cards: These allow you to make purchases or send payments by borrowing money from your credit line.

Cash App also allows you to store funds directly within the app, which can then be used for transactions. However, when you need to add funds to your Cash App balance or send money to others, you’ll typically use either a debit card or a credit card.

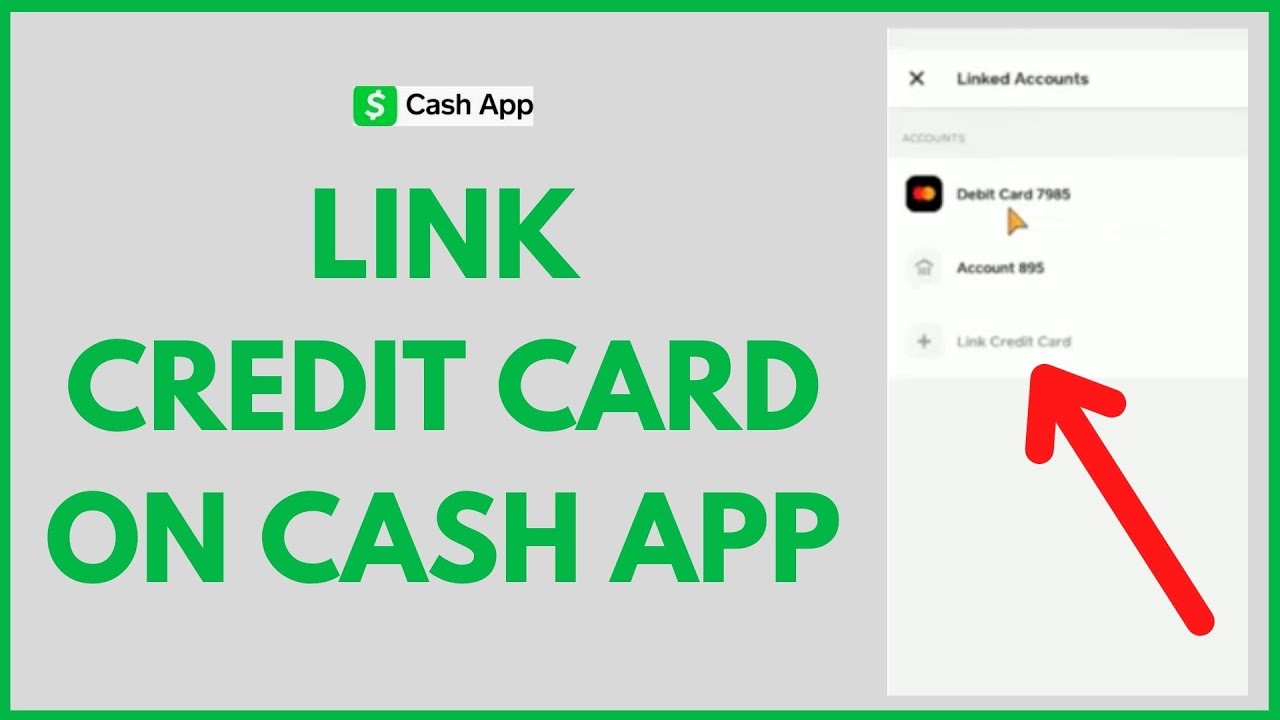

How to Connect a Credit Card to Cash App

The process of linking a credit card to your Cash App account is straightforward. Here’s a step-by-step guide:

- Open Cash App: Launch the Cash App application on your smartphone.

- Tap the Banking Tab: Look for the banking tab (usually represented by a bank icon) at the bottom left corner of the screen and tap it.

- Select ‘Add Bank’: Scroll down until you find the option to ‘Add Bank’. Selecting this option allows you to add either a bank account or a card.

- Choose ‘Add Card’: You’ll be presented with options to link a bank account or a debit/credit card. Select the option to add a card.

- Enter Card Details: Manually enter your credit card number, expiration date, CVV code, and billing zip code. Ensure all information is accurate to avoid any issues.

- Confirmation: After entering the details, Cash App might ask you to confirm your identity through a verification process, such as sending a code to your registered phone number or email address.

Once the verification is complete, your credit card will be successfully linked to your Cash App account. You can now use it to send money or add funds to your Cash App balance.

Benefits of Using a Credit Card on Cash App

Using a credit card on Cash App offers several potential advantages:

- Convenience: It provides an alternative payment method if you don’t have sufficient funds in your bank account or prefer not to use your debit card.

- Rewards: If your credit card offers rewards points, cashback, or other perks for purchases, you can earn these rewards when using your card through Cash App.

- Flexibility: It allows you to make payments even if you’re waiting for funds to clear in your bank account.

Limitations and Fees Associated with Credit Card Use

While there are benefits to using a credit card on Cash App, it’s essential to be aware of the limitations and fees involved:

- Transaction Fees: Cash App typically charges a fee when you use a credit card to send money. This fee is usually around 3% of the transaction amount. This fee does not apply when using a debit card or your Cash App balance.

- Cash Advance Fees: Some credit card issuers might classify Cash App transactions as cash advances, which can trigger higher interest rates and additional fees. It’s crucial to check with your credit card issuer to understand their policies regarding transactions made through payment apps like Cash App.

- Spending Limits: Cash App imposes spending limits on transactions made using credit cards. These limits are designed to protect users from fraud and unauthorized transactions.

Potential Risks and Considerations

Using a credit card on Cash App also comes with potential risks that you should consider:

- Debt Accumulation: Over-reliance on using your credit card for Cash App transactions can lead to debt accumulation if you’re not careful about paying off your balance on time.

- Security Risks: While Cash App employs security measures to protect your information, there’s always a risk of data breaches or unauthorized access to your account. It’s crucial to practice good security habits, such as using a strong password and enabling two-factor authentication.

- Impact on Credit Score: High credit card utilization (the amount of your available credit that you’re using) can negatively impact your credit score. Using your credit card frequently on Cash App and carrying a high balance can potentially lower your creditworthiness.

When Should You Use a Credit Card on Cash App?

Deciding when to use a credit card on Cash App depends on your individual circumstances and financial habits. Here are some scenarios where it might be appropriate:

- Emergency Situations: If you need to send money urgently and don’t have sufficient funds in your bank account or Cash App balance, using a credit card can be a viable option.

- Earning Rewards: If your credit card offers attractive rewards for purchases, using it on Cash App can help you accumulate points or cashback.

- Temporary Cash Flow Issues: If you’re experiencing a temporary cash flow shortage and need to make a payment, using a credit card can provide a short-term solution.

However, it’s essential to avoid using your credit card on Cash App for non-essential transactions or if you’re already struggling with debt. Over-reliance on credit cards can lead to financial difficulties and should be avoided.

Alternatives to Using a Credit Card on Cash App

If you’re concerned about the fees or risks associated with using a credit card on Cash App, consider these alternatives:

- Debit Card: Linking your debit card to Cash App is generally the most cost-effective option, as there are typically no transaction fees.

- Cash App Balance: Transferring funds from your bank account to your Cash App balance and using that balance for transactions can help you avoid credit card fees.

- Other Payment Methods: Explore other payment apps or services that might offer lower fees or better terms for your specific needs.

[See also: Cash App vs Venmo: Which is Best?]

Tips for Managing Credit Card Use on Cash App

If you choose to use a credit card on Cash App, follow these tips to manage your usage responsibly:

- Track Your Spending: Monitor your Cash App transactions closely to keep track of how much you’re spending on your credit card.

- Pay Off Your Balance: Pay off your credit card balance in full each month to avoid interest charges and maintain a good credit score.

- Set a Budget: Establish a budget for your Cash App spending and stick to it to avoid overspending.

- Review Credit Card Statements: Regularly review your credit card statements for any unauthorized transactions or errors.

Conclusion

Can you connect a credit card to Cash App? Yes, you can. Connecting a credit card to Cash App can be convenient, especially in certain situations. However, it’s crucial to be aware of the fees, risks, and potential impact on your credit score. By understanding these factors and managing your usage responsibly, you can make informed decisions about whether using a credit card on Cash App is the right choice for you. Always prioritize responsible spending habits and consider alternatives when possible to minimize costs and risks.